Federal Credit Union: Dependable and Protected Financial in Wyoming

Federal Credit Union: Dependable and Protected Financial in Wyoming

Blog Article

Lending Institution: Your Course to Better Banking

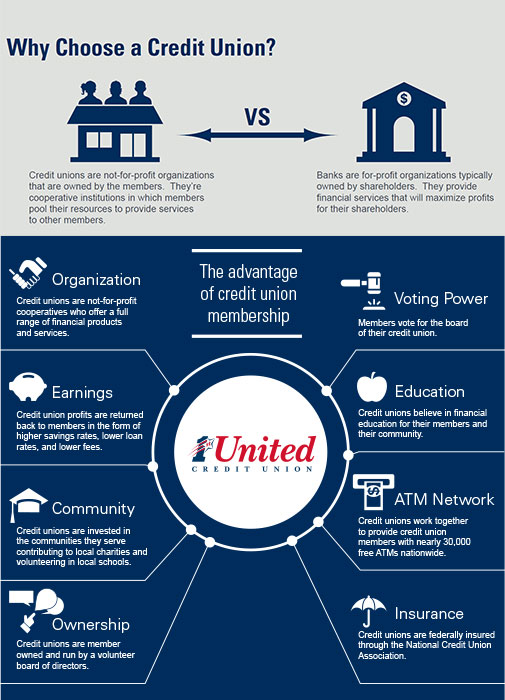

In the realm of contemporary financial, Credit report Unions attract attention as a sign of tailored community-centric worths and monetary remedies. Their distinct approach to financial exceeds the typical version, offering members a course to much better economic health via competitive rates and tailored solutions. By promoting a sense of belonging and focusing on specific demands, Lending institution have redefined the financial experience. However what establishes them apart in today's competitive landscape?

Advantages of Cooperative Credit Union

Credit scores unions supply a variety of advantages that establish them apart from typical banks in terms of customer service and community involvement. Credit report unions are not-for-profit companies, implying they focus on giving affordable prices on financial savings accounts, fundings, and credit cards for their members.

Furthermore, debt unions are deeply rooted in the neighborhoods they serve. They frequently involve in community outreach programs, sponsor regional events, and support philanthropic reasons. By promoting these links, credit report unions contribute to the financial growth and development of their areas.

Additionally, cooperative credit union generally have lower costs and supply better rates of interest compared to standard banks. Participants commonly profit from reduced funding passion rates, greater returns on interest-bearing accounts, and decreased or no fees for services like examining accounts or ATM withdrawals. This economic advantage can cause significant lasting savings for members.

Personalized Solution

With a focus on customized attention and tailored financial options, participants of cooperative credit union profit from a high degree of customized service. Unlike traditional banks, cooperative credit union focus on building strong relationships with their participants by comprehending their special financial requirements and goals. This personalized strategy enables cooperative credit union personnel to give personalized recommendations, referrals, and options that line up with each participant's specific situation.

One key aspect of individualized service at credit rating unions is the ease of access of team member. Members typically have direct access to decision-makers and monetary experts, fostering a more receptive and personal banking experience. Whether a participant requires assistance with a financing application, economic planning, or dealing with an issue, credit rating union team are conveniently offered to supply assistance and assistance.

Moreover, cooperative credit union strive to exceed transactional communications by developing count on and rapport with their participants (Federal Credit Union). By learning more about individuals on an individual degree, credit history unions can much better offer their monetary demands and provide tailored solutions that help participants attain their goals. This dedication to customized service collections cooperative credit union apart and develops an extra beneficial and appealing financial relationship for members

Competitive Prices

In today's affordable economic landscape, debt unions offer members attractive rates that can boost their total banking experience. Unlike traditional banks, lending institution are not-for-profit organizations owned by their members, allowing them to concentrate on giving affordable rates instead than making the most of earnings. This one-of-a-kind structure allows cooperative credit union to use lower passion prices on finances, higher rates of interest on interest-bearing accounts, and fewer charges compared to many large financial institutions.

Competitive prices are a significant advantage for lending institution participants when looking for financial products such as home mortgages, vehicle blog lendings, or credit cards. By using reduced rate of interest, lending institution assist members save cash over time and achieve their monetary objectives more efficiently. Additionally, the greater rate of interest on interest-bearing accounts make it possible for members to expand their cash faster and raise their financial savings possibility.

Community-Focused Efforts

Whether via contributions, sponsorships, or volunteer work, credit unions demonstrate their devotion to making a positive effect past simply monetary services. These efforts not only strengthen the bond in between the credit rating union and its members yet additionally foster a feeling of solidarity and cooperation among neighborhood members.

Boosted Banking Experience

An Enhanced Financial Experience differentiates lending institution by prioritizing personalized solutions customized to satisfy the distinct monetary demands of their members. Unlike standard financial institutions that usually focus on profits, cooperative credit union place a solid emphasis on participant fulfillment and monetary well-being. This tailored strategy permits cooperative credit union to supply an array of advantages that improve the general financial experience for their members.

One secret element of an Enhanced Financial Experience is the focus on building solid relationships with members. Credit score union team typically take the time to understand each participant's individual financial objectives and challenges, supplying customized suggestions and support to aid them make informed decisions. This individualized touch produces a sense of trust and commitment in between the debt union and its participants, cultivating a resilient collaboration.

Furthermore, credit score unions regularly offer competitive rates on financial savings and loans items, aiding members save money and accomplish their financial objectives faster. The focus on participant solution and fulfillment collections credit scores unions apart in the banking sector, making them a favored choice for people seeking an extra satisfying and individualized banking experience.

Verdict

Credit scores unions are not-for-profit companies, indicating they prioritize supplying affordable prices on financial savings accounts, loans, and credit report cards for their members.Competitive rates are a significant advantage for debt union participants when looking for financial products such as mortgages, car car loans, or credit history cards. By offering workshops, workshops, and sources on subjects like budgeting, conserving, and credit score structure, debt unions actively add to the financial wellness of family members and people.

These initiatives not only reinforce the bond in between the credit score union and its members yet additionally foster a sense of uniformity and teamwork among area participants. By prioritizing member complete satisfaction and providing customized monetary options, Credit history Unions demonstrate a commitment to equipping their members and developing solid, trust-based connections.

Report this page